A dynamic and constantly growing reality

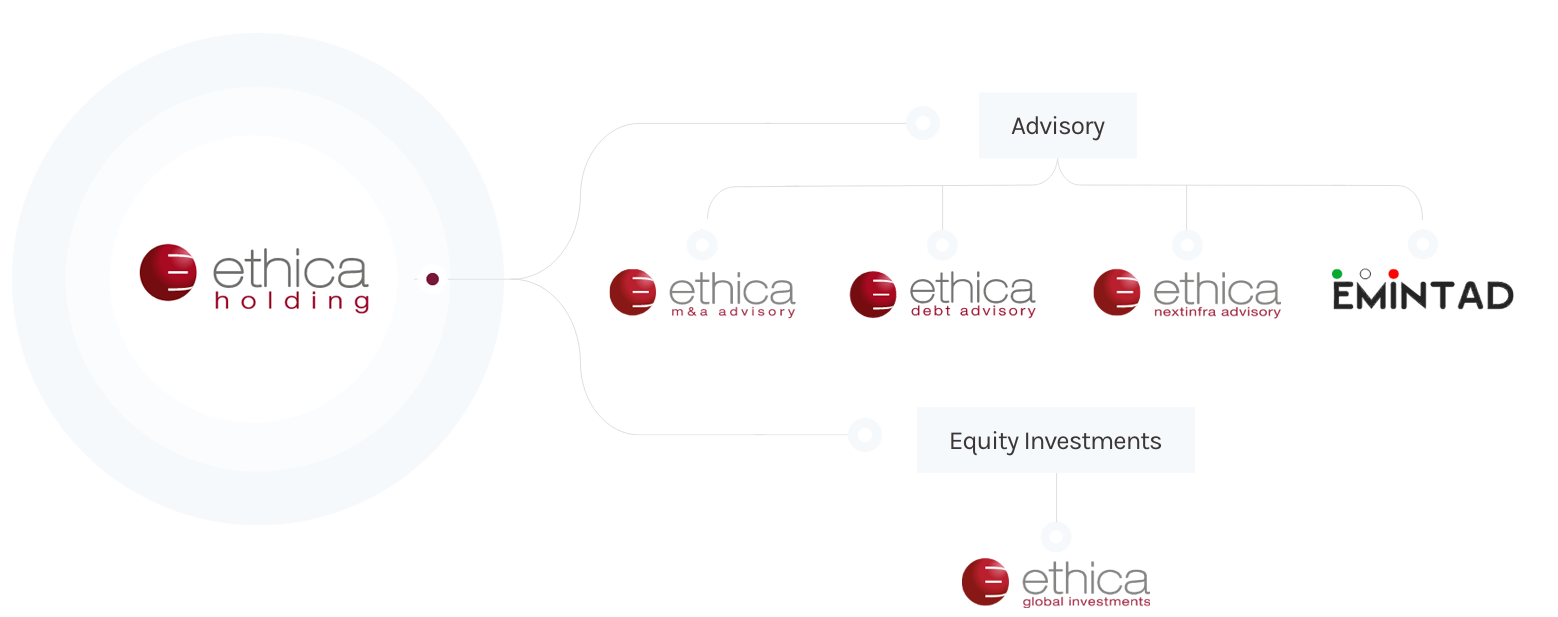

Organization

Our group consists of a holding company and 4 companies specialising in extraordinary finance transactions and direct investment in venture capital.

- Ethica M&A Advisory specialises in building and executing transactions involving the sale, merger and acquisition of companies, businesses or shareholdings

- Ethica Debt Advisory provides structured and alternative finance services

- Ethica NextInfra Advisory focuses exclusively on infrastructure projects, offering M&A and Debt Advisory services

- Emintad specialises in listing on regulated and unregulated markets

- Ethica Global Investments is the holding company that invests in Italian SMEs

Track Record

Since 2010, our companies have completed multiple extraordinary finance transactions in various industrial sectors, working alongside entrepreneurs, large international groups and Italian and foreign financial investors.

*Emintad transactions not included herein

History

2010

2014

2016

The joint venture in Debt Advisory is realised with the Mittel Group listed on the Milan Stock Exchange.

2018

2019

The entire capital of Ethica Debt Advisory is acquired from the Mittel Group.

2022

The ECM Advisory division is born through the partnership with Emintad

2024

Ethica Advisory is born and capital is opened to new Partners

2025

Ethica NexInfra Advisory is born